As a unit of study, this 3rd Grade Personal Financial Literacy Unit is unique to the Texas Essential Knowledge and Skills Standards. The deeper I got into this curriculum, the more I wondered, “Why is that?” All students deserve to have as many tools as possible to prepare them for their financial future!

Unit 8 has 3 mini-units with 9 lessons that guide students through many important aspects of our economy, including education, experience, work, pay, and basic money management concepts.

3rd Grade Unit 8 Mini-Units

- Mini-Unit 1: Education, Experience, and Income

- Mini-Unit 2: Supply and Demand

- Mini-Unit 3: Managing Your Money

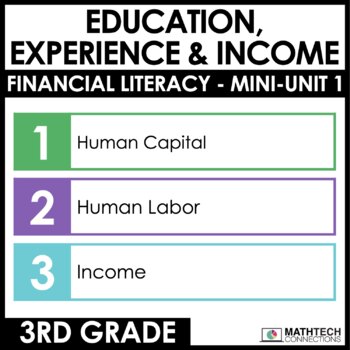

Mini-Unit 1: Education, Experience, & Income

Human capital is the term used to describe our unique human characteristics that allow us to live and function in society. In Mini-Unit 1, will explore some examples of human capital and how it relates to our talents, interests, and ideas. People’s human labor is how they earn income to buy the things they want and need. Human capital and human labor are interconnected in a variety of ways. Both concepts are related to income, which the money humans make.

Education and experience influence income over one’s lifetime. Human capital influences decisions we can make to increase that income in order to have a more financially stable life. Money doesn’t buy happiness! But understanding how key decisions can influence your financial success can go a long way towards financial peace of mind.

Students will study examples of human capital and labor, and how they interact with education and experience to make up the backbone of our economy. Students will explore different jobs and careers, and ways people can become equipped to be who they want in life. While a college education would be ideal for all, it can be a crippling expense, especially when associated with student loans. People can exercise their human capital to find new ways to be successful in the world today!

Mini-Unit 2: Supply & Demand

Never has this topic been timelier and more relevant. The economic cycles of supply and demand are directly linked to consumer prices, affordability, and even business health. In Mini-Unit 2, students will interact with many simulations that look at the complex web required to provide the things we want and need in our lives.

They will think about changes in the supply of goods, including limited natural resources and supply chain issues. Demand can change based on supply, prices, or even trends in society. This brief mini-unit will help 3rd graders have a better understanding of the “big picture” concepts that impact them every day.

Mini-Unit 3: Managing Your Money

Everyone could use more education about money management! While some children get an allowance or get paid to do chores, the topic of financial resources doesn’t usually reach them until much, much later.

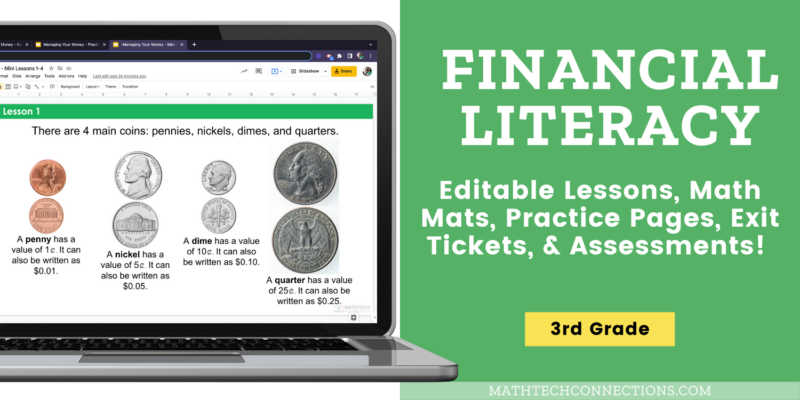

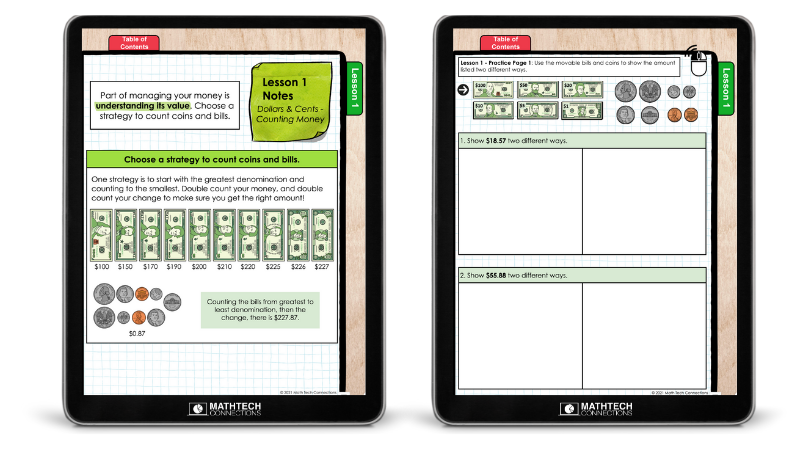

Mini-Unit 3 opens with a lesson about counting money. Cash isn’t always used in our society these days. It’s important for children to understand what their electronic payments and income represent – money that is actually in the bank. Counting collections of different denominations of coins and bills is also great cognitive exercise, reinforcing addition, subtraction, and counting skills.

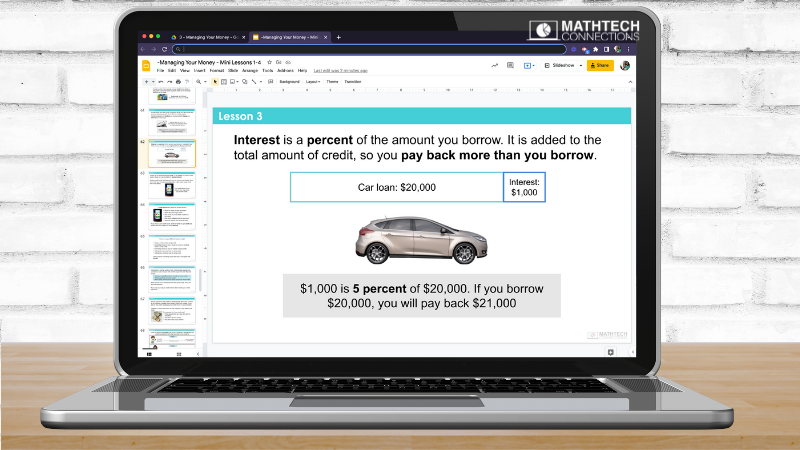

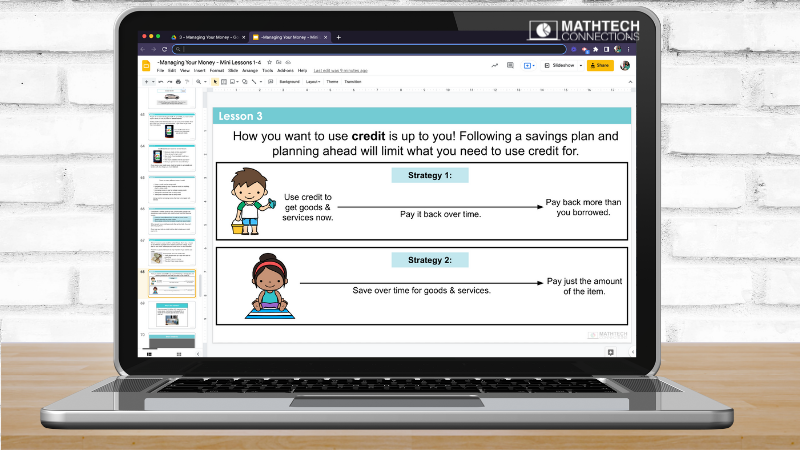

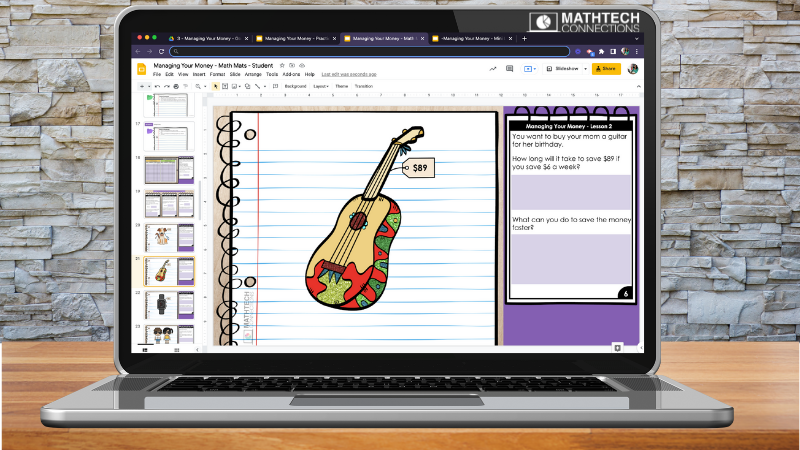

Students will be introduced to saving money based on their income, basic credit concepts, and simple budgets to manage their income. Charitable giving is also introduced as a way children can help others and give back with what they have to share. Students will come away with an understanding of what it means to “Manage Your Money.”

While it is the societal norm for parents to manage family finances, there’s no reason why children can’t participate in their own financial life. They can make decisions about saving for the future, working to increase their income, and even starting businesses to build wealth at an early age.

Digital Guided Math Activities Included!

Each component of the 3rd Grade Guided Math Curriculum comes in printable and digital versions to maximize your flexibility teaching these important concepts. YOU can choose which version of each lesson component should be used – and when – for your diverse learners.

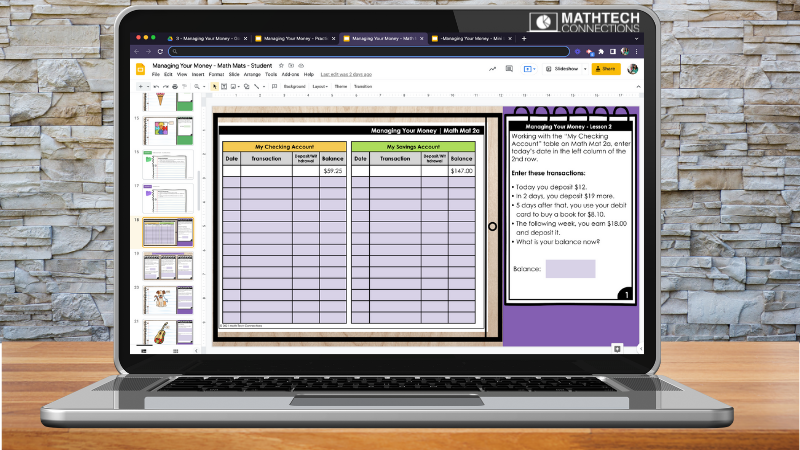

Digital lessons introduce and model each financial literacy concept.

Digital Math Mats and Task Cards are also included.

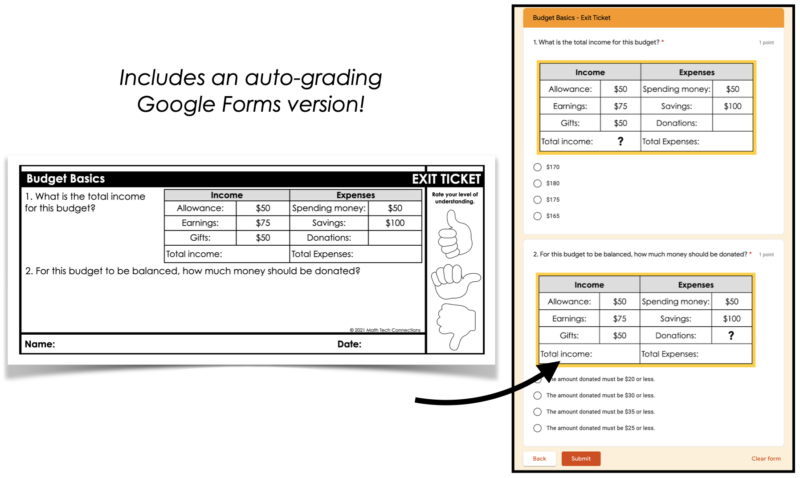

Each lesson includes a Digital Exit Ticket to give you a snapshot of student learning. Exit tickets are such an important formative assessment for your planning process as a teacher. Full-color Digital Practice Pages also use interactive movable digital pieces to allow students to demonstrate their learning in a more independent way.

Bundle & Save with the complete Unit 8 – Financial Literacy bundle!

Read Related Blog Posts ↓

- About the 3rd Grade Guided Math Curriculum

- 3rd Grade Unit 1: Multiplication & Division

- 3rd Grade Unit 2: Place Value

- 3rd Grade Unit 3: Addition & Subtraction

- 3rd Grade Unit 4: Fractions

- 3rd Grade Unit 5: Measurement

- 3rd Grade Unit 6: Graphing

- 3rd Grade Unit 7: Geometry

- 3rd Grade Unit 8: Money & Financial Literacy

Leave a Comment